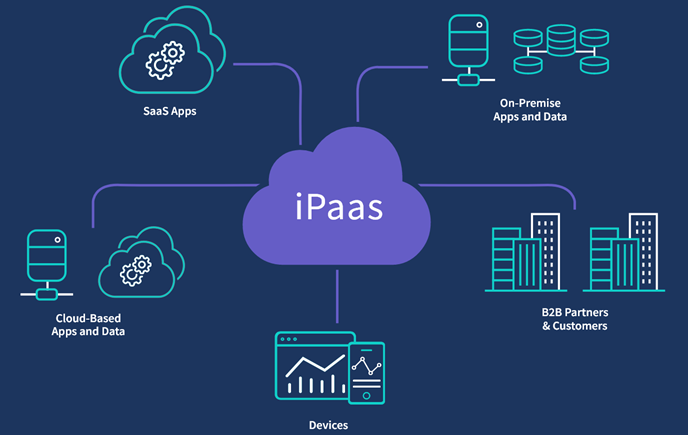

The Japan Integration Platform As A Service Market Market Leaders are a stratified group, with leadership defined not just by global technology rankings, but by deep market penetration, the strength of their local partner ecosystems, and their success in capturing key market segments within Japan. The leadership landscape must be viewed through different lenses: large enterprise platform leadership, domestic mid-market leadership, and implementation/service leadership. In the large enterprise segment, the clear software platform leaders are the global giants, most notably Salesforce (with MuleSoft) and Boomi. Their leadership is a direct function of their ability to address the complex hybrid integration challenges faced by Japan's largest corporations. As these companies undertake major digital transformation (DX) initiatives, they require a powerful, enterprise-grade platform that can connect their legacy, on-premises systems with a growing portfolio of cloud-based SaaS applications, and MuleSoft and Boomi are the recognized leaders in this demanding space. The Japan Integration Platform As A Service Market size is projected to grow USD 1500 Million by 2035, exhibiting a CAGR of 10.77% during the forecast period 2025-2035.

In the crucial and vast Japanese small and medium-sized enterprise (SME) segment, the leadership belongs firmly to the domestic Japanese vendors. The undisputed leader in this space is Asteria with its ASTERIA Warp platform. Their leadership is built on a two-decade-long history of focusing exclusively on the needs of the Japanese mid-market. Their platform is renowned for its reliability, its ease of use for non-specialist IT staff, and its vast library of connectors to both global SaaS applications and, crucially, to the specific domestic software packages that are popular in Japan. This deep localization and reputation for quality and support in the Japanese language gives them a formidable competitive moat that global players have found incredibly difficult to breach, making them the de facto standard for iPaaS in the Japanese SME sector.

Finally, and perhaps most importantly in the Japanese context, the leadership in the "delivery and integration" of these complex iPaaS solutions is dominated by the major domestic system integrators (SIs). Companies like NTT Data, Fujitsu, and Hitachi are the market leaders in actually implementing, customizing, and managing iPaaS projects for enterprise clients. Their leadership is based on their vast pool of skilled consultants, their deep relationships with the clients, and their role as the prime contractor and trusted advisor. In the mind of many large customers, the SI is the true "leader" of their integration strategy. This makes the SIs the kingmakers of the industry; their decision on which iPaaS platforms to partner with and recommend is a primary determinant of the technology vendors' market leadership in Japan, highlighting the collaborative nature of market dominance in this unique ecosystem.

Top Trending Reports -

UK AI ML in Media and Entertainment Market